Creating a sales invoice line

Learn how to add sales invoice lines to your sales invoice

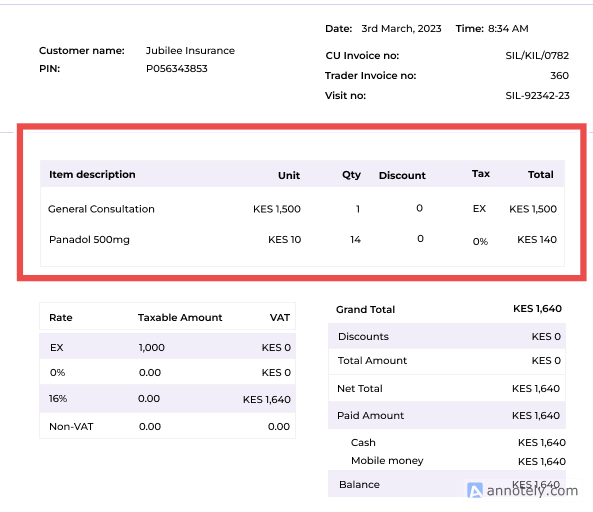

A sales invoice line refers to a detailed entry on a sales invoice that specifies a particular product or service sold, including its description, quantity, unit price, and applicable taxes. Each line represents an itemized part of the overall invoice, ensuring transparency and accurate calculation of totals and taxes.

In eTIMS (Electronic Tax Invoice Management System), sales invoice lines are critical for complying with Kenya Revenue Authority (KRA) requirements by providing itemized transaction details.

After creating a sales invoice we need to create sales invoices as well.

Purpose of a Sales Invoice Line

- Enhance Transaction Clarity

It breaks down an invoice into individual components for easy understanding. - Simplify Tax Calculations

It facilitates the calculation of VAT and other applicable taxes on a per-item basis. - Ensure Compliance

It provides detailed and accurate records required for KRA audit and verification purposes. - Improve Financial Record Keeping

It enables precise tracking of products or services sold.

Steps to Create a Sales Invoice Line

- Create Sales Invoice

Using Slade360 APIs(sales invoice endpoint) create a new sales invoice or edit an existing draft invoice. - Add a Sales Invoice Line

Find the Add Invoice Line button or section within the invoice creation form. Use the Create Sales Invoice Line endpoint to include the invoice line in the sales invoice body. - Input Item Details

For each item or service, enter the following information:- Item Description

Provide a brief but specific description of the product or service being sold (e.g., “50kg Cement Bag” or “Consultation Service – 1 Hour”). - Quantity

Specify the number of units sold. Ensure that the quantity aligns with the transaction record. - Unit Price

Enter the price per unit of the product or service (e.g., KES 800 per bag of cement). - Tax Category

Select the applicable tax rate for the item. It might be either:- VAT (e.g., 16% for standard-rated items).

- Exempt or zero-rated, if applicable.

- Discount (if applicable)

Include any discount offered per unit or for the total quantity. - Total Before Tax

The system will calculate this as Quantity × Unit Price. - Tax Amount

Slade360 eTIMS APIs automatically applies the selected tax rate to compute the tax amount. - Line Total (Including Tax)

This is the sum of the total before tax and the tax amount.

- Item Description

- Save the Invoice Line

After entering all details for the item, click Save Line or Add Line to save the entry. This can also be performed by using the post request on the sales invoice line endpoint. - Add Additional Invoice Lines (if required)

Repeat the above steps to add more lines for additional items or services sold. - Review Invoice Lines

Verify all entries to ensure that item descriptions, quantities, prices, and taxes are correct. - Save or Generate the Invoice

Once all lines have been added, proceed to save or generate the final invoice.

Best Practices for Creating a Sales Invoice Line

- Ensure Accurate Item Descriptions

Use clear and concise descriptions to avoid confusion or disputes. - Verify Tax Categories

Double-check that each item is assigned the correct tax rate to comply with KRA regulations. - Cross-Check Totals

Ensure that line totals match transaction records for consistency and accuracy. - Minimize Manual Errors

Where possible, use preloaded product lists or automated systems to reduce errors in entry.

Benefits of Detailed Sales Invoice Lines

- Transparency

It allows customers to see exactly what they are paying for, including taxes. - Compliance

It meets KRA’s itemization requirements for tax invoice reporting. - Efficiency

It simplifies record-keeping and reconciliation of sales data. - Audit Readiness

It provides clear, itemized records for financial audits or tax verifications.

For more in-depth information, please visit:Sales.

Why use Slade360 APIs to create Sales Invoice Line?It helps a businesses in creating accurate and compliant sales invoice lines in eTIMS that ensures a smooth invoicing process, regulatory compliance, and a transparent relationship with customers and tax authorities.

Updated 9 months ago